It's crucial to evaluate your budget and ensure you could have a practical plan for compensation before taking out a 24-hour loan.

It's crucial to evaluate your budget and ensure you could have a practical plan for compensation before taking out a 24-hour loan. Understanding the potential pitfalls might help you avoid adverse monetary outco

Various types of credit loans cater to totally different financial needs. For instance, private loans are sometimes unsecured, allowing borrowers to make the most of the funds for a variety of private expenses, while residence equity loans are secured towards property, normally providing lower rates of interest as a result of backing of actual est

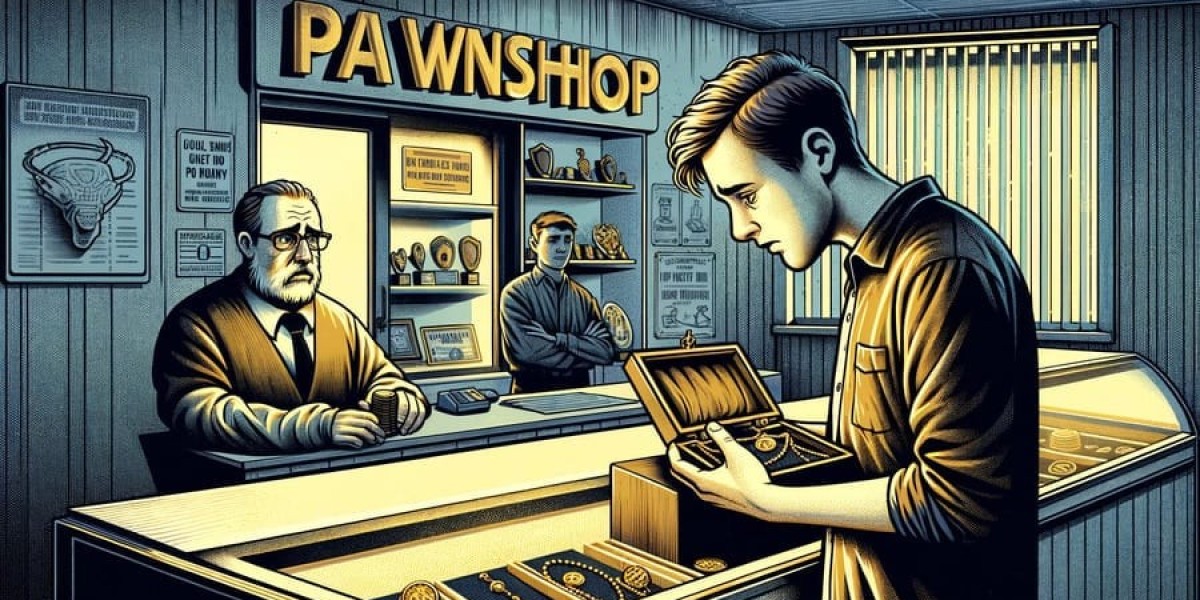

The loan amount is decided based mostly on the assessed worth of the item being pawned. Pawnshops usually supply a percentage of the item's worth, considering factors like situation, age, and market demand. It’s advisable to get your items appraised at multiple outlets to guarantee you receive a fair prov

When considering a 24-hour mortgage, make positive to evaluate the lender's reputation and the terms of the settlement rigorously. Payday lenders and different financial institutions typically offer these loans, however their practices and charges

visit Totokr Totokr can vary considerably. Make it a priority to understand all terms to keep away from falling into a cycle of d

Furthermore, if borrowers are unable to repay the mortgage by the due date, they may find themselves in a cycle of debt, continually rolling over the mortgage into new borrowing intervals. This can shortly escalate the entire quantity owed, resulting in a precarious financial scena

If you find yourself unable to make mortgage payments, contact your lender immediately. They may provide solutions such as refinancing or a temporary forbearance. Avoid defaulting, as this will seriously influence your credit score. Consider in search of monetary advice to explore your options and develop a plan to handle your de

Another in style reason for choosing a monthly mortgage is debt consolidation. Many individuals combine multiple money owed into a single month-to-month loan to simplify funds and potentially safe a lower overall interest r

BePick: Your 24-Hour Loan Resource

BePick is an excellent website for anyone looking to explore 24-hour loans. The platform provides detailed evaluations of varied lenders, permitting users to match options efficiently. By using BePick's sources, you probably can achieve insights into rates of interest, charges, and buyer experiences. This info is invaluable for ensuring that you simply make a well-informed determinat

Importantly, borrowers retain ownership of their items in the course of the loan interval. If the loan is repaid, you probably can recover your pawned item. However, should you default, the pawnshop has the right to sell the collateral to recuperate the loan amount. This makes pawnshop loans a viable possibility for those seeking speedy funding with out the stringent necessities of standard financial instituti

How to Apply for a Small Loan

Applying for a small mortgage is generally a straightforward course of. Most lenders offer an internet platform for purposes, requiring basic personal and financial data. To start, potential debtors ought to identify their wants and analysis lenders that specialize in small lo

Customer critiques can also provide useful insights into a lender's reliability and customer support. Trustworthy lenders will usually have a observe document of glad purchasers who can vouch for his or her experien

Understanding credit loans is crucial for anybody looking to handle their funds properly. Credit loans are monetary products that enable debtors to entry funds with the understanding that they will repay the quantity, normally with interest, over a predetermined period. These loans may be beneficial for numerous functions, together with debt consolidation, main purchases, or

Emergency Fund Loan bills. However, potential borrowers should concentrate on several types of credit loans, eligibility standards, rates of interest, and the repercussions of failing to repay. For these in search of detailed insights and reviews on credit loans, BePick provides a wealth of data to help consumers make informed selecti

It’s important to understand how the interest rate impacts the whole value of the mortgage. A greater interest rate can substantially enhance the amount paid over time, making it important to buy round for the very best ra

Managing Your Small Loan Repayment

Once you've got secured a small loan, managing your compensation is essential to hold up financial well being. Start by adhering to the agreed-upon fee schedule. Setting reminders for cost due dates can forestall late funds and potential penalt

What is a Pawnshop

Real Estate Loan?

A pawnshop mortgage is a kind of secured mortgage the place borrowers supply their private belongings as collateral. This may vary from jewellery, electronics, and even musical instruments. Unlike traditional loans that require intensive credit score checks and lengthy waiting periods, pawnshop loans present immediate cash. The quantity you'll find a way to borrow sometimes is decided by the worth of the item being paw

rockland auto parts q688z7hggly208

Ved shaunteg629354

rockland auto parts q688z7hggly208

Ved shaunteg629354 Hướng dẫn cá cược tỷ số bóng đá bằng công nghệ toán học

Ved TRAN KHOA

Hướng dẫn cá cược tỷ số bóng đá bằng công nghệ toán học

Ved TRAN KHOA Cách Làm Cho Cây Mai Ra Nhiều Nhánh, Nhiều Cành

Ved nguyenbich

Cách Làm Cho Cây Mai Ra Nhiều Nhánh, Nhiều Cành

Ved nguyenbich Купить диплом магистра с проводкой.

Ved elizagage67267

Купить диплом магистра с проводкой.

Ved elizagage67267 Cách Đặt Cược Bóng Đá Mà Không Thua – 3 Chiến Lược Vượt Trội

Ved TRAN KHOA

Cách Đặt Cược Bóng Đá Mà Không Thua – 3 Chiến Lược Vượt Trội

Ved TRAN KHOA