The appeal of fast funding loans lies of their velocity. Unlike traditional loans which will require intensive documentation and take weeks to process, these loans may be sorted out inside hours or days. This rapid entry is particularly helpful for people going through urgent financial obligati

Improving your probabilities of obtaining a small mortgage involves maintaining a great credit score score, demonstrating regular earnings, and preparing necessary documentation corresponding to bank statements or proof of employment. Comparing multiple lenders also can help you discover the most effective phrases and improve your chance of appro

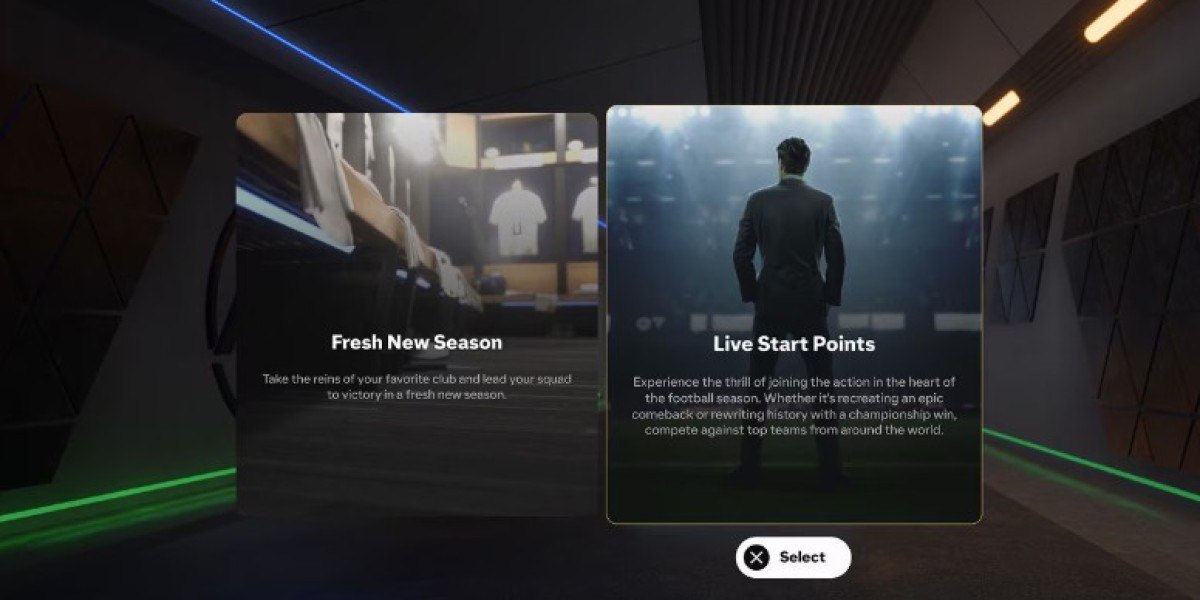

The Application Process

The utility course of for on-line installment loans has advanced, making it extra easy than ever. Typically, lenders require basic private info, income verification, and banking particulars to facilitate transf

The Application Process

The utility course of for fast funding loans is generally simple. Online lenders typically present a user-friendly platform the place borrowers can submit their purposes inside minutes. Information wanted typically includes personal identification, earnings verification, and banking deta

n Eligibility requirements for fast funding loans may range by lender. Generally, borrowers should provide proof of identification, a gradual supply of earnings, and be of legal age. Lenders can also carry out a credit score check to assess repayment functionality, though some lenders specialize in loans for those with poor credit sc

It’s additionally essential to have a steady earnings source to reassure lenders about your capability to repay the mortgage. Some institutions could supply small loans with no credit score examine, concentrating on those who could have lower scores. However, these would possibly come with greater prices. Borrowers ought to ensure they absolutely understand the phrases and conditions connected to any mortgage they think ab

n Yes, some lenders focus on offering installment loans to people with unfavorable credit score ratings. However, these loans usually come with larger rates of interest and charges. It is important to fastidiously consider all phrases before continuing and contemplate alternate options that might be more value effective in the lengthy t

Furthermore, Bepick frequently updates its content material to mirror the latest developments within the lending market, ensuring that users have access to essentially the most present information. Whether you are a seasoned entrepreneur or a budding startup, Bepick is the go-to destination in your financing quer

The convenience of applying for a mortgage from the comfort of your office or home further enhances the enchantment of fast enterprise loans on-line. As expertise continues to evolve, lenders are continuously on the lookout for methods to simplify the application course of and enhance buyer experie

Common Misconceptions

Many people harbor misconceptions about quick enterprise loans on-line. One prevalent fantasy is that these loans come with exorbitant interest rates. While some lenders may indeed charge greater charges because of the speed of approval, quite a few rivals offer reasonable charges that are competitive with conventional lend

By understanding the nuances of on-line installment loans and correctly utilizing the resources out there through platforms like 베픽, debtors can make informed selections that positively impact their monetary future. Proper analysis and planning can result in a sustainable method to borrowing, ensuring individuals can meet their financial obligations without unnecessary str

Understanding Quick Business Loans

Quick business loans are designed to provide rapid funding for enterprise expenses. They permit entrepreneurs to entry money more swiftly than traditional Student Loan alternate options, making them enticing for urgent financial needs. The process typically involves filling out an internet application, which could be accomplished in minu

Once the appliance is submitted, lenders typically provide a decision quickly—sometimes immediately. This fast response time is among the key advantages of on-line lending. If approved, debtors can anticipate to receive funds shortly thereafter, offering them the means to deal with their monetary emergenc

Moreover, failure to repay a small loan on time may find yourself in significant harm to a borrower’s credit score, compounding the difficulty further. It is essential for debtors to carefully assess their financial state of affairs and make positive that they will meet repayment commitments before taking on any d

On the other hand, small enterprise loans are tailored for entrepreneurs trying to fund their ventures. These loans might help start-ups cowl initial expenses such as stock, gear, or staffing. Generally, they require a stable marketing strategy and may have Additional Loan collateral, but several lenders supply no-collateral choices to assist small companies. Additionally, payday loans are another type of small mortgage, usually due on the borrower's next payday; nonetheless, they often include high-interest rates and must be approached with caut

探す

人気の投稿